massachusetts estate tax rates table

A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. The adjusted taxable estate used in determining the allowable credit for state death.

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16.

. For instance if your homes assessed value is 300000 and your local taxing district has a tax rate of 10 your annual Massachusetts property tax bill will add up to 3000. Longmeadow has the highest property tax rate in Massachusetts with a property tax rate of 2464. What To Know About The 2020 Estate Tax Exemption In Massachusetts Ladimer Law Office Pc.

Dont leave your 500K legacy to the government. Visit The Official Edward Jones Site. This means if the value of an.

This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. A guide to estate taxes Mass Department of Revenue. The estate tax rate for Massachusetts is graduated.

The total Massachusetts estate tax due on his estate would be 280400 or 238800 41600 104 of 400000 the amount of the estate over 3540000. Additionally because the taxable estate of. Only to be used prior to the due date of the M-706 or on a valid Extension.

A local option for cities or towns. Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines. Home Massachusetts Tax Table.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad Get free estate planning strategies. 50 personal income tax rate for tax year 2021.

Ad Get free estate planning strategies. Massachusetts income tax rate and number. If youre responsible for the estate of someone who died you may need to file an estate tax return.

The estate rate tax depends on the size of the estate. Massachusetts Tax Forms 2020 Printable State Ma. Sales rate is in the top-20 lowest in the US.

Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes for free.

Dont leave your 500K legacy to the government. To figure out how much your estate will need to pay in estate taxes. Note this calculator is for.

The Massachusetts Estate Tax applies to individuals with assets worth over 1 Million and the tax rate varies. The filing threshold for 2022 is 12060000. Ad Find Recommended Massachusetts Tax Accountants Fast Free on Bark.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attrorney Forms. Massachusetts Estate Tax Rate. Compared to other states.

Look up your property tax rate from the table above. Starting in 2023 it will be a 12 fixed rate. A state excise tax.

Massachusetts uses a graduated tax rate which ranges between. Up to 25 cash back In Massachusetts the estate tax rate is based on a historical federal credit for state death taxes. New Look At Your Financial Strategy.

Massachusetts Estate Tax Overview. Masuzi May 14 2014 Uncategorized Leave a comment 25 Views. The table below lists all of the rates.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. More details on estate taxes in Massachusetts are. 2022 Property Tax Rates.

To find out the exact state estate tax owed in 2021 see the. Get Access to the Largest Online Library of Legal Forms for Any State. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

Connecticut S Estate Tax. The graduated tax rates are capped at 16. The estate tax rate is based on the value of the decedents entire taxable estate.

The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will. 2022 Massachusetts Property Tax Rates. The Massachusetts State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Massachusetts State Tax CalculatorWe.

The tax rate ranges from 116 to 12 for 2022. Get your free copy of The 15-Minute Financial Plan from Fisher Investments. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

A state sales tax. If a person is subject to both the Federal and State tax then.

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Estate Tax Everything You Need To Know Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

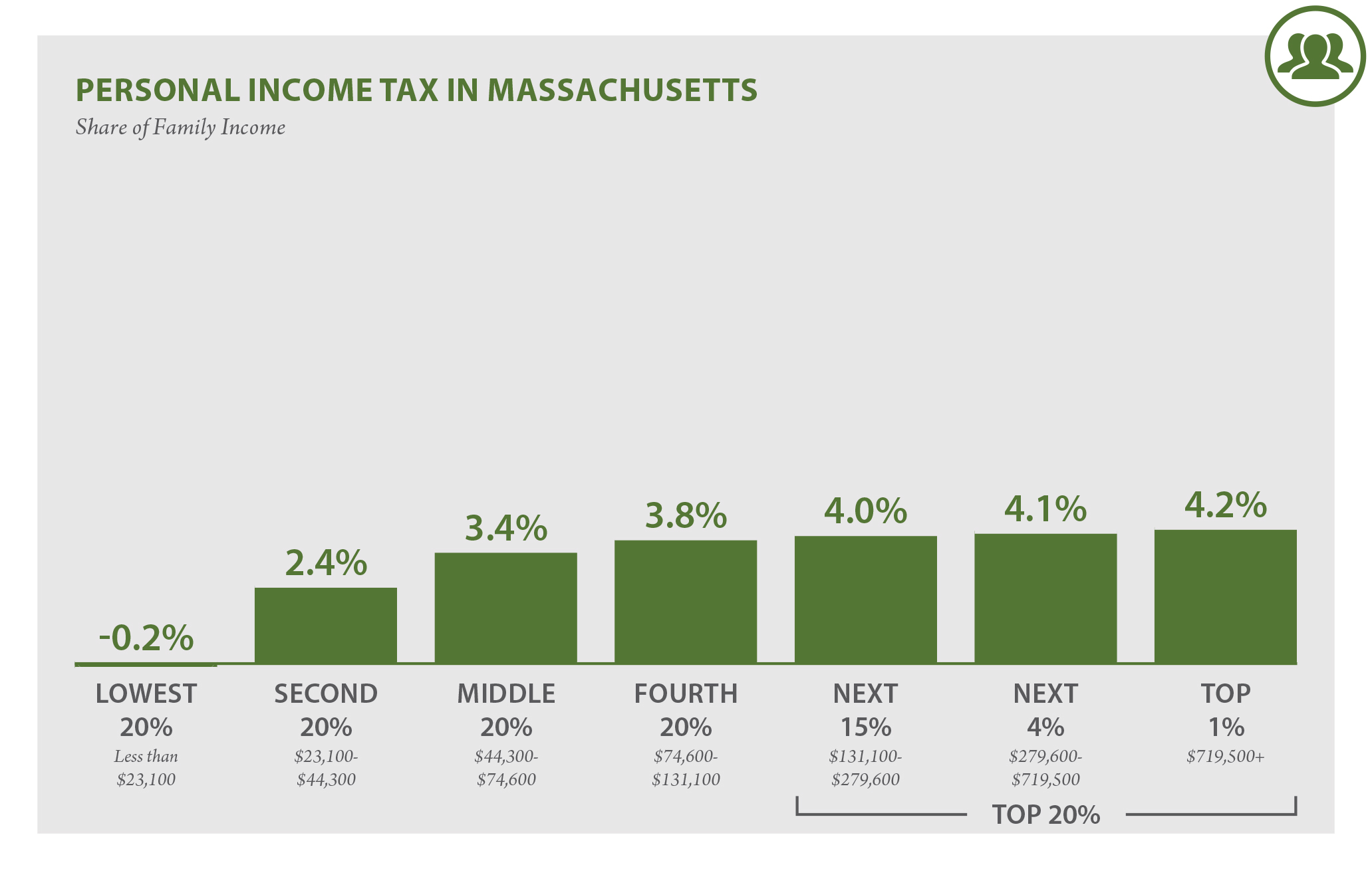

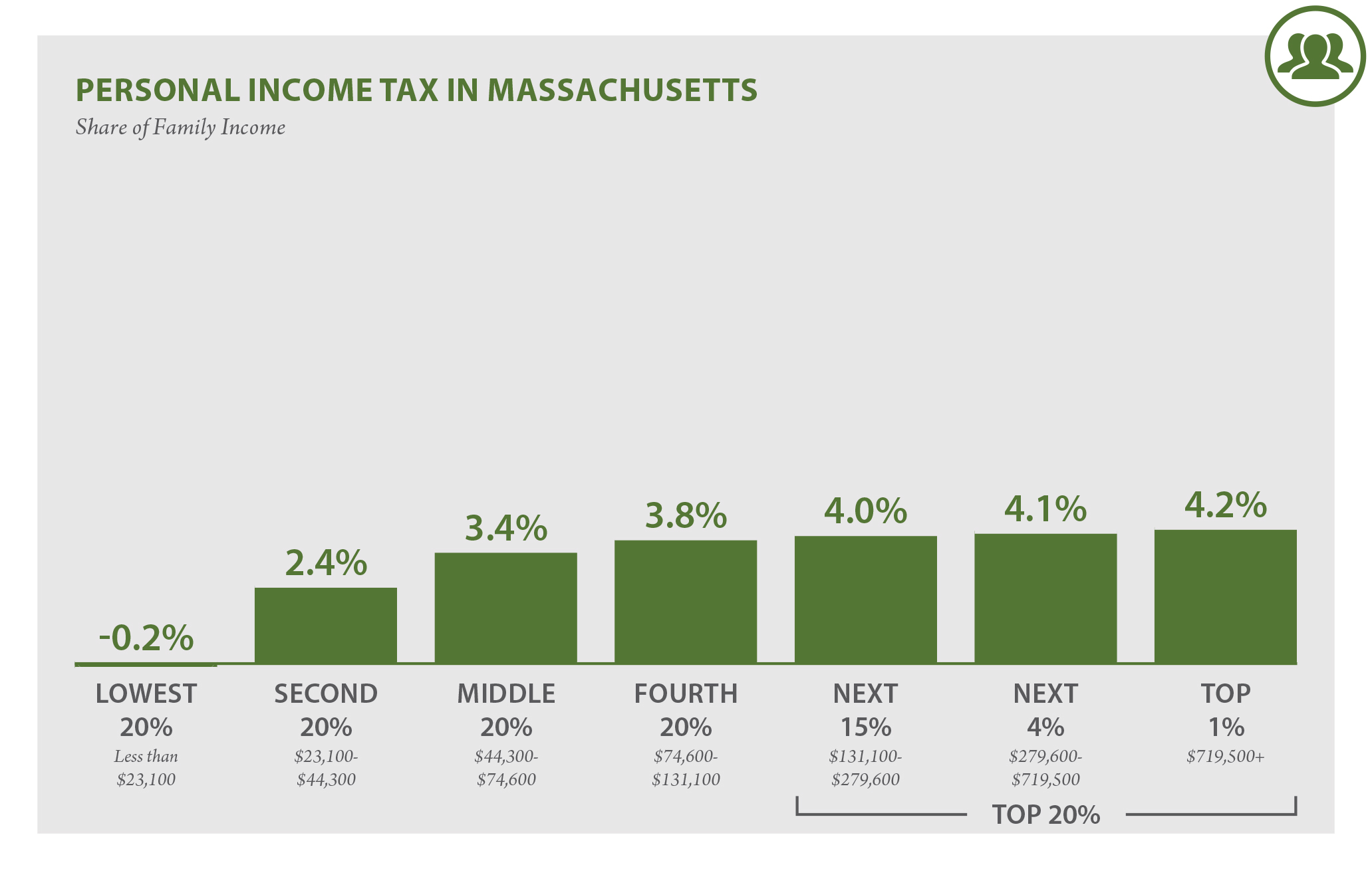

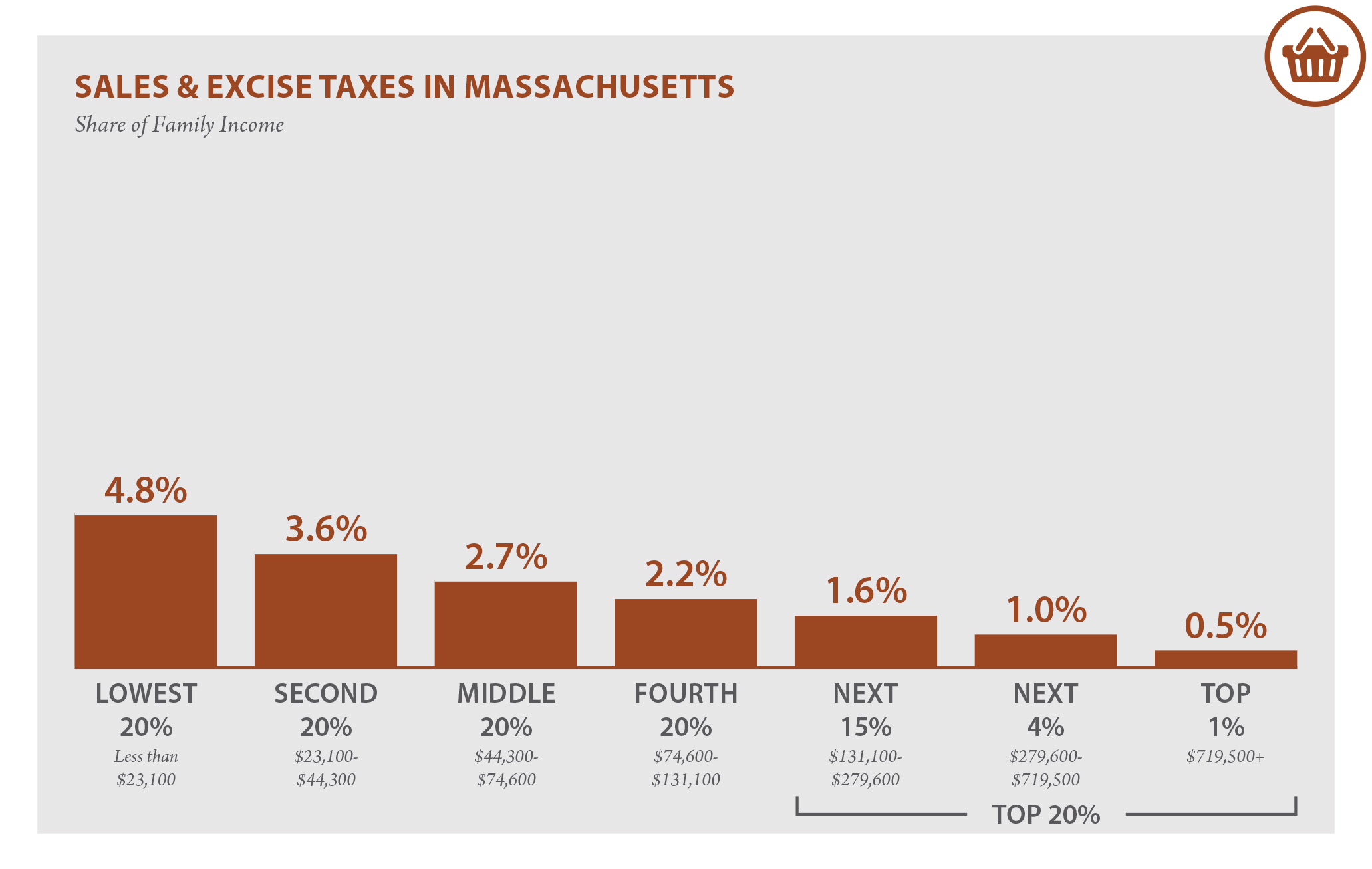

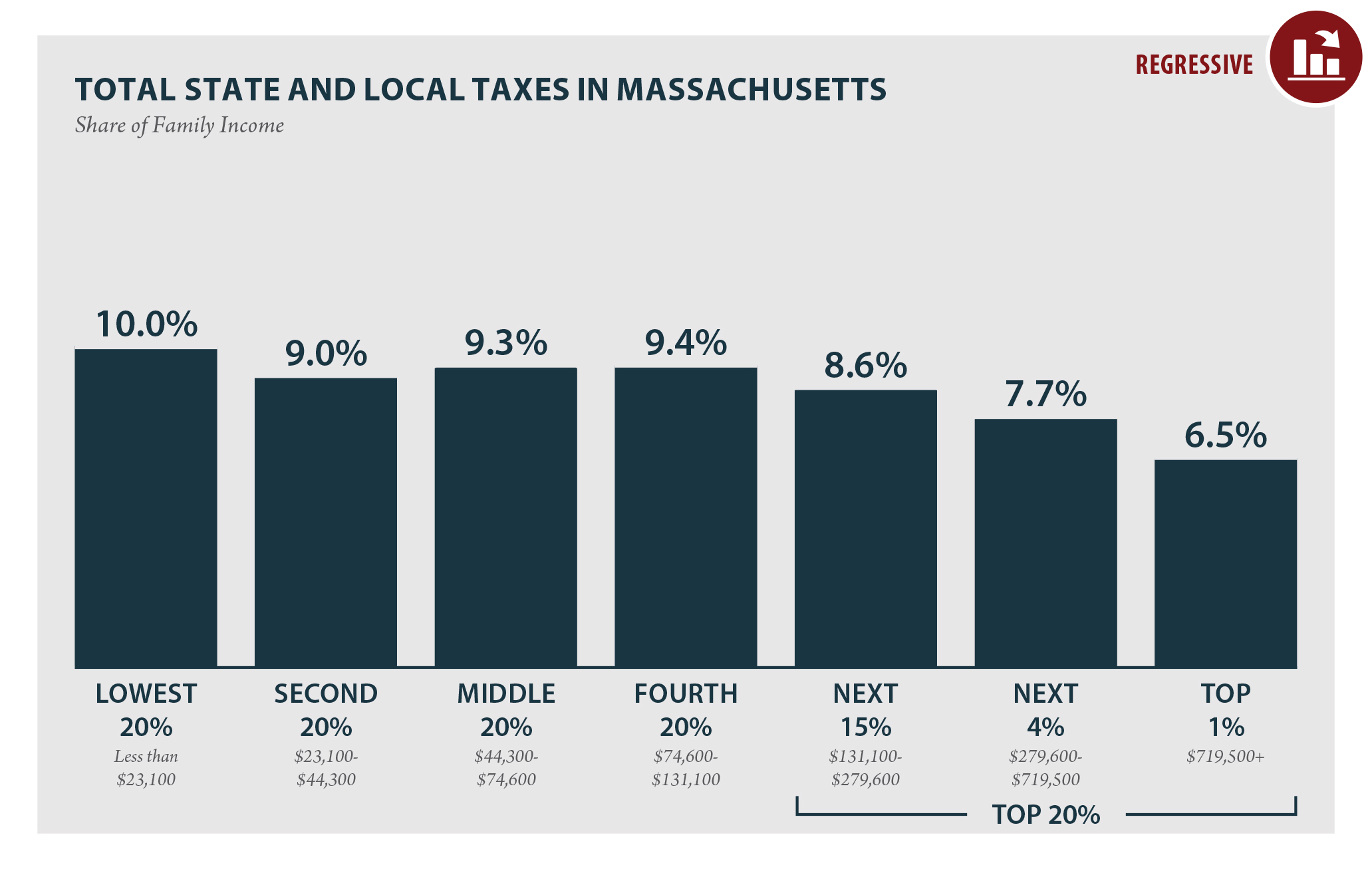

Massachusetts Who Pays 6th Edition Itep

Massachusetts Who Pays 6th Edition Itep

The Kiddie Tax Changes Again Putnam Investments

Massachusetts Who Pays 6th Edition Itep

State Corporate Income Tax Rates And Brackets Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Massachusetts Who Pays 6th Edition Itep

Income Tax Brackets For 2022 Are Set

How Is Tax Liability Calculated Common Tax Questions Answered

A Guide To Estate Taxes Mass Gov

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Estate Tax Everything You Need To Know Smartasset